April 2024 Online Annuity Rates & Quotes

Best: Fixed Rates

Fixed Index Rates

Immediate SPIA Quotes

Online Annuity Quotes – No Sales Calls!

For help or a personalized annuity rates quote. Contact us.

state specific rates, features, ratings, fees, riders, & annuity quotes.

Today’s Top Ten Fixed Annuity Rates

Annuity rates & reviews are powered by AnnuityRateWatch.com’s database. ALL reviews are subject to change and accuracy is never guaranteed since rates and features change frequently. Reviews are provided for conceptual and educational purposes only. REVIEWS ARE NOT AN ANNUITY SOLICITATION.

Are Annuities a Good or Bad Option for Your Retirement?

Calculators for Online Annuity Quotes

& Best Annuity Rates Online to Create

Your Retirement Income Plan Now!

Retirement and annuity calculators online can assist you in your research towards a more secure, tax free or tax deferred retirement. The right online calculators can help with calculations on **guaranteed minimum interest rates and income or projected higher potential growth. These calculations typically show deferred taxation on earnings until withdrawn from the account. Use the best annuity calculators (annuity rates 2022) such as the fixed index annuity calculator, variable annuity# calculator, or immediate annuity calculator to help you determine how these annuities might fit into your retirement plan. Additionally, take advantage of our Do-It-Yourself, Free, Advanced – Retirement Income Planning Calculator, which helps you create your own unique retirement plan that you can save or print.

Ten Frequent Annuity Questions on How To:

1. Reduce your uncertainty or fear of running out of money in retirement?

“Your Retirement Success is Our First Concern”

One of the biggest fears in retirement is outliving your money; whether you have modest means or millions saved, the same fear exists according to documented surveys from those retiring. One of the greatest concerns is financial uncertainty especially when it comes to stock market risk affected by events outside of one’s control. Hence, MarketFree® annuities – free from market risk – offer lifetime **guarantees for at least some portion of your money. These **guarantees can come in the form of immediate annuities or annuitization where you give up control of your lump sum or the newer income riders that allow you to maintain majority control of your entire account value. Read more…

2. Retain your gains and help avoid risking your assets in volatile markets?

Video: Protecting Your Assets With Annuities

MarketFree® annuities are not just for income. Many retirees use annuities to diversify for safety similar to the way they would use bonds in a stock/bond portfolio. Fixed-index or Hybrid style annuities are designed to give fixed income interest gains that compete with bond returns while eliminating the credit risk associated with bonds. Annuities always have built-in safeguards for **guaranteed lifetime income (protecting against longevity risk) that bonds, US Treasuries, and banking instruments cannot offer. Many retirees use them as the foundation for their portfolio to accomplish steady growth with principal protection. Read more…

“Your Retirement Success is Our First Concern”

3. Help protect your spouse from running out of money if you are the one that passes first?

Video: Avoid Spousal Impoverishment!

Most couples have multiple income streams that continue to pay while both are living such as social security, pensions, annuities, investments, and etc. Unfortunately, when a spouse passes pre-maturely or should we say unexpectedly, some of these important income streams may be reduced or stop altogether. It becomes more difficult when the spouse who managed the assets passes first and leaves the grieving spouse with a responsibility he or she is not ready for. Annuities that are set up correctly in advance can be turned-on if needed to immediately fill the income shortfall and take the pressure of the grieving spouse in making difficult financial decisions. Read more…

“Your Retirement Success is Our First Concern”

4. Create your own more secure personal pension with annuities, that you alone control?

Video: Annuities Offer Pension-Style Income, That You Direct

The good old days of company pensions are just a memory for most. The vast majority of companies have already dumped defined benefit pension plans replacing them with qualified employee savings plans such as 401ks, 457bs, and 403bs. Others are offering lump-sum buyouts to off-load their pension liability. So, where does that leave the folks with no pension who have amassed some assets for retirement? The choices seem to be taking the same market risk individually that employers as a whole have not fared so well at or transfer risk to a pension-style annuity income. Annuities now offer many new retirement options to fit the needs of today’s retirees. Read more…

“Your Retirement Success is Our First Concern”

5. Effectively use MarketFree™ Index Annuities to hedge against inflation?

“Your Retirement Success is Our First Concern”

Since the 2009 Great Recession, inflation has been well under control averaging less than 3 percent. However, during the four decades preceding inflation averaged just over 4 percent annually. Many would argue that the economy has been set up for another round of high inflation based on huge government stimulus programs. Most retirees understand that even modest inflation can dramatically reduce their buying power over twenty to thirty years. So, a balanced portfolio approach of laddering annuities with substantial future income **guarantees* or utilizing annuities with increasing income formulas can help retirees sleep better without gambling everything on market risk alone as their only inflation hedge! Read more…

Using MarketFree® Fixed Index Annuities to Fight Against Inflation

6. Beating low interest rates banks are offering with much higher annuity intrest rates?

“Your Retirement Success is Our First Concern”

When interest rates started their free-fall in 2008, who would have predicted that by 2017 we would still be witnessing bank rates way below 1 percent? The government has immense powers in manipulating interest rates. Unfortunately, this directly affects conservative savers who rely on higher bank interest rates to make their money last in retirement. In addition, federal reserve chairwoman Janet Yellen, continues saying “do not expect higher interest rates for quite some time; only expect small incremental increases.” On the other hand, fortunately, Multi Year Guarantee Annuities [MYGA] are available with about a 3 percent yield for a five-year maturity while growth oriented fixed index annuities [FIA] offer growth potential of 3-7% – both protect your principal/premium from market loss. Read more…

Video: Annuities Can Offer Higher Interest Growth With Safety

7. Avoid unnecessary tax by using annuities without creating a tax trap?

Video: Avoid Paying Unnecessary Tax or Falling into a Future Tax Trap!

The last thing anyone needs is an unintended taxable event that could have been avoided with proper retirement planning; that leverages IRS statutes to avoid tax. Annuities are no exception to this type of planning; they are financial vehicles that have many tax-favorable attributes. However, they also have some pitfalls that require proper execution and long-term planning that is specifically tailored to meeting defined retirement objectives. Structured correctly, annuities can be extremely tax efficient and in certain strategies produce tax-free growth and income as well as wealth transfer. Read more…

“Your Retirement Success is Our First Concern”

8. Calculate the correct percentage of assets you need in annuities to retire securely?

“Your Retirement Success is Our First Concern”

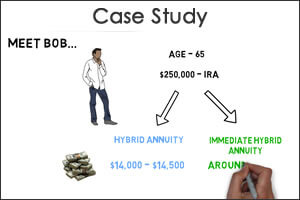

Deciding just how much of your portfolio should go into annuities is a question that depends on many factors that are tied to your retirement objectives; and advice from financial professionals can vary widely. Those who consider themselves a super annuity salesman may suggest most if not all of your assets in annuity; those who focus on managing investments or selling securities may advise against any annuities. The truth probably lies somewhere in the middle. As the Annuity Guys®, we believe that you should back into your annuity portfolio percentage by first determining your foundational income need. This will allow you to establish the least amount of money you should initially consider for annuities. You can always increase the percentage, if you need to, later, consider additional factors. Read more…

Video: How Much Money Should You Place in Annuities to Retire Securely?

9. Know for certain that your money is safer, with higher rated insurance companies?

Video: So, How Can Annuities Keep Your Money Safe?

Staying with A-rated or higher insurance companies is so important. Third party rating agencies give you a heads-up if a particular company is having trouble. The one thing that insurance companies do best is manage risk. Most of the companies that offer annuities have been through up and down business cycles for one hundred years or more; facing a depression, recessions, wars, and pandemics. The number one responsibility that insurance companies have is protection of their policyholders. Read more…

“Your Retirement Success is Our First Concern”

10. Annuity 4% - 6% Caps Vs. IMEC 10% - 17% Caps (With Tax Free Long Term Care Benefits)

Use A+ rated insurance backed IMECs, having the potential to Net 7% to 14% safely!

Index Modified Endowment Contract [IMEC™]

Safety, Growth, Liquidity, Tax Free Transfer & No Market Risk:

- Higher indexing interest rates up to 15%+ & NO downside market risk to your principle;

- Minimum Guarantees up to 3% (can offset fees or costs);

- Annual Locked In Gains;

- No 1099s or IRS Tax Reporting in deferral;

- Safety A to A++ AM Best High Rated Carriers;

- 100 Percent Liquidity is possible with no surrender charges;

- Transfer Wealth TAX FREE;

- Death Benefit Up to 400% or more of cash account value;

- Tax Free Long Term Care & Home Health Care;

- IRS Approved IRC 72(e) and 7702.

“Your Retirement Success is Our First Concern”

Annuity Research Tools

- Today’s Reviews & Rates

Over 4,000 Annuity Reviews & Rates - Instant Download

Retirement & Annuities eBook - Retirement Calculators

Six Retirement & Annuity Calculators - Learn The Annuity Basics

Nine Video Annuity Course From A-Z - A Special Gift

Bonus – Four Powerful Annuity Tools

Fun Video: Financial Planner or Convincing Salesman?

2024 FINANCIAL ADVISOR SUMMARY REPORT

Before Buying Annuities – Compare Annuity Rates & Safety Ratings!

Finding the lowest dollar amount of your assets to transfer into the safest annuities can be vital to your retirement’s success. Here, on our Annuity Guys’ website, you can have access over 4,000 Annuity Rates – Reviews, Features, Ratings, Riders & Fees plus hundreds of posts with helpful annuity information and over 250 exclusive retirement and annuity videos subscribed to and watched by thousands with over a million views. Annuity Rates, calculators, video topics, and related posts are here to help answer your annuity questions, so you can make truly informed annuity decisions. “We will only call if you request our assistance, we will never call uninvited”. Hence, if you are ready for a personalized retirement or annuity consultation just let us know and it will be our privilege to assist you.

Finding the lowest dollar amount of your assets to transfer into the safest annuities can be vital to your retirement’s success. Here, on our Annuity Guys’ website, you can have access over 4,000 Annuity Rates – Reviews, Features, Ratings, Riders & Fees plus hundreds of posts with helpful annuity information and over 250 exclusive retirement and annuity videos subscribed to and watched by thousands with over a million views. Annuity Rates, calculators, video topics, and related posts are here to help answer your annuity questions, so you can make truly informed annuity decisions. “We will only call if you request our assistance, we will never call uninvited”. Hence, if you are ready for a personalized retirement or annuity consultation just let us know and it will be our privilege to assist you.

Prior to Committing Your Retirement Assets to Fixed Index Annuities…

“Make an Informed Decision based on income, ratings, and key facts – Compare FIAs!”

Our helpful visitor survey finds:

- Most Fixed Index Annuity owners with higher rated Hybrid annuities are pleased.

- A portion of Fixed Index Annuity owners did not adequately understand their purchase.

- Those who chose the lesser rated insurers were less confident with their decision.

- Some purchasers believe their agent left-out key facts and did not inform them fully.

- Few owners, after purchasing, felt Fixed Index annuities were not in their best interest.

- Those who structured Hybrid annuities for maximum income with reduced or no annual fees were more likely to recommend this type of annuity to others.

Empowering Annuity Reference Book

Instant Download – Save $19.95

Our Recent Saturday Morning Retirement & Annuity Vlogs...

- “Why can’t we all just get along?” It seems that the spirit of divisive partisan politics has invaded the investment world of annuities vs securities and more specifically fixed index annuities. For a myriad of reasons it seems many advisors...

- Negative statements and hyperbole inherently make strong headlines, grabbing our attention! The financial industry is very guilty of using this sensationalism, rather it’s negative or positive in getting our attention, so their emotionally charged sales pitch can reach us!...

- Remember the yellow page ads from years ago – “Let your fingers do the walking, it’s a snap!” The yellow pages still exist in the phone book (I think), but how often do you use them to make a...

- There is a saying in the annuity world that annuities are sold, not bought! Yes, at times this may be true, some annuities can be complex and may take more explaining/selling to understand how they can help your retirement...

- Practicing as a financial advisor is an honorable profession that is dishonored when its practitioners employ abusive and deceptive sales practices. Oftentimes, the root causes of abusive, unethical practices are a lack of character and integrity which can manifest...

- I would wager that everyone has used the phrase “You get what you pay for” in describing a less than desirable outcome after choosing some type of less expensive option. However, can the same axiom be used when considering annuities? Of course...

Wake Up to Our Saturday Morning Retirement and Annuity Videos ...

Easy Subscribe - Newly Released Informative Annuity Guys® Videos on Saturday MorningsWe hope you will enjoy our retirement and annuity videos each Saturday morning. Retirements are always facing new challenges in our fast changing world.

As Annuity Guys we report on retirement changes for better or worse, so you can stay updated on tax saving strategies, Social Security, annuity planning for income and growth, wealth transfer strategies and the latest retirement scams and gimmicks to avoid! Subscribe free and enjoy a new retirement topic every Saturday morning, videos go great with coffee or tea!

Comprehensive Site Terms & Disclosure

** Guarantees, including optional benefits, are backed by the claims-paying ability of the issuer, and may contain limitations, including surrender charges, which may affect policy values. Annuities are not FDIC insured and it is possible to lose money.

Annuities are insurance products that require a premium to be paid for purchase.

Annuities do not accept or receive deposits and are not to be confused with bank issued financial instruments.

During all video segments, Dick and Eric are referring to Fixed Annuities unless otherwise specified.

*Retirement Planning and annuity purchase assistance may be provided by Eric Judy or by referral to a recommended, experienced, Fiduciary Investment Advisor in helping Annuity Guys website visitors. Dick Van Dyke semi-retired from his Investment Advisory Practice in 2012 and now focuses on this Annuity Guys Website. He still maintains his insurance license in good standing and assists his current clients.

Annuity Guys’ vetted and recommended Fiduciary Financial Planners are required to be properly licensed in assisting clients with their annuity and retirement planning needs. (Due diligence as a client is still always necessary when working with any advisor to check their current standing.)

Comprehensive Site Terms & Disclosure

- All annuity tools, videos or information visible on Annuity Guys website pages, television, or other media are for educational and conceptual purposes only.

- Annuity tools, videos or information are not to be considered investment advice, insurance recommendations, tax or legal advice.

- It is recommended that site visitors should work with licensed professionals for individualized advice before making any important or final financial decisions on what is best for his or her situation.

- Website comments are not considered investor testimonials those shown only relate to an insurance agent referral service, customer service, or satisfaction with the purchase of insurance products and are never based on any investment or securities advice or investment or securities performance.

- Please be aware that your feedback and compliments may be shared with our visitors or those that may be interested in our services we will never give out your full name or full address or phone number without your permission. By sending us your feedback & comments you agree to allow us full use in sharing your comments with others in public forums. Thank you for sharing.

- Media logos are not any type of endorsement, they only imply that one or more of the Annuity Guys have written for, been quoted by, or appeared on the listed news outlet, broadcast or cable channels, or branded programs for non-advertising and/or advertising purposes, to offer educational and conceptual information about retirement issues incuding annuities.

- Income is guaranteed by annuitization or income riders that may have additional costs or fees.

- http://www.annuityguys.net & http://www.annuityguys.com forward to https://annuityguys.org. – Further all disclosures and information are to be considered as one and the same for any and all URL forwards, and these same disclosures and information also apply to all YouTube videos featuring Dick & Eric where ever they are viewed.

- MarketFree™ Annuity Definition: Any fixed annuity or portfolio of fixed annuities that protects principal / premium and growth by remaining market risk free.

- Market Free™ (annuities, retirements and portfolios) refer to the use of fixed insurance products with minimum guarantees that have no market risk to principal and are not investments in securities.

- Market Gains are a calculation used to determine interest earned as a result of an increasing market related index limited by various factors in the annuity contract. These can vary with each annuity and issuing insurance company.

- Premium is the correct term for money placed into annuities principal is used as a universal term that describes the cash value of any asset.

- Interest Earned is the correct term to describe Market Free™ Annuity Growth; Market Gains, Returns, Growth and other generally used terms only refer to actual Interest Earned

- Market Free™ Annuities are fixed insurance products and only require an insurance license in order to sell these products; they are not securities investments and do not require a securities license.

- No Loss only pertains to market downturns and not if losses are incurred due to early withdrawal penalties or other fees for additional insurance benefits.

- Annuities typically have surrender periods where early or excessive withdrawals may result in a surrender cost.

- Market Free™ Annuities may or may not have a bonus. Some bonus products have fees or lower interest crediting and when surrendered early the bonus or part of the bonus may be forfeited as part of the surrender process which is determined by each annuity contract.

- MarketFree™ Annuities are not FDIC Insured and are not guaranteed by any Government Agency.

- Annuities are not Federal Deposit Insurance Corporation (FDIC) insured and their guarantees are based on the claims paying ability of the issuing insurance company.

- State Insurance Guarantee Associations (SIGA) vary in coverage with each state and are not to be confused with FDIC which has the backing of the federal government.

- Annuity Guys website is not affiliated with or endorsed by the Social Security Administration.

- *“Best” refers only to the opinion of Dick, the Annuity Guys site author; or the opinion of Dick & Eric in videos and is not considered best for all individuals.

- *“APO” refers only to the Annual Pay-Out of annuities in the guaranteed lifetime income phase. *APO is NOT an annual yield or an annual rate of interest.

- AnnuityRateWatch.com, is only a linked to subscription service, which is not affiliated with AnnuityGuys.com, it supplies and updates all Annuity Rates, Features Ratings, Fees and Riders. AnnuityRateWatch.com’s information is available in the public domain and accuracy is not verified or guaranteed since this type of information is always subject to change.

- Dick helps site visitors when help is requested. Dick may receive a referral fee as compensation from an advisor for a prospective client referral. This helps compensate Dick for time spent assisting site visitors and maintaining this educational website.

- Eric Judy is both insurance licensed and securities licensed. Eric offers securities as an investment adviser representative through Client One Securities, LLC.

- Eric purchases prospective client referrals from Annuity Guys Ltd. and may be compensated by commission for helping prospective clients purchase annuities. Eric may also recommend these prospective clients to an annuity advisor and earn a referral fee or a referral commission split.

- Vetted annuity advisors refers to advisors that are insurance licensed and recommended based on referral experience from satisfied clients.

- Any recommendation of an advisor is only one aspect of any due diligence process. Each site visitor must accept full individual responsibility for choosing a licensed insurance agent/advisor.

- In the event that a recommended licensed advisor/agent is not considered satisfactory, Eric will make reasonable efforts to recommend other advisors one at a time in an attempt to satisfy a site visitors planning or purchasing needs.

- Dick is the https://annuityguys.org website author and editor, Annuity Guys Ltd. is the website owner; Eric is a guest video commentator. Videos gathered from other public domain sources may also be used for educational and conceptual purposes.

- There is NO COST to site visitors when they are given an advisor referral or recommendation.

- By giving the Annuity Guys your contact information such as email, phone number, address and etc. you are giving your permission to be contacted or sent additional relevant information about annuities, retirement and related financial information. Annuity Guys has a NO SPAM policy.

- Accuracy of website information is strived for but is not guaranteed.

- Freedom from virus or malware is strived for but is not guaranteed. Website visitors accept any and all risk associated with damage to any computer for any reason when using this website and hold this website harmless from any liability.

- Use this website like the vast majority of websites at your own risk. No risk or liability of any type are accepted by any business entity or any of the information providers for this website.